Crypto Exchange Wash Trading Detection and Prevention

If you’re trading or building in the crypto space, you can’t ignore the risks wash trading poses—not just to individual investors, but to the credibility of entire exchanges. As technology evolves and market infrastructure fragments, detecting and stopping such manipulation isn’t straightforward. Regulators are closing in, but the challenge is bigger than rules alone. So, how can you spot deceptive trading and what more can be done to protect market integrity?

Defining Wash Trading and Its Effects on Crypto Markets

Wash trading is defined as a practice in which traders simultaneously buy and sell the same asset to create a misleading impression of market activity and demand. In the context of cryptocurrency markets, this often involves the use of coordinated accounts that execute trades involving numerous tokens, thereby generating an illusion of liquidity. Such practices have significant implications, as they can mislead both institutional and retail investors by distorting real market conditions.

The fraudulent nature of wash trading qualifies it as a considerable financial crime, necessitating vigilance from regulatory authorities and market participants alike.

To effectively detect and prevent such activities, firms are encouraged to implement advanced surveillance technologies, perform continuous transaction analyses, and set up alert systems to flag suspicious trading patterns.

Adherence to regulatory frameworks established by organizations such as the Securities and Exchange Commission (SEC) is essential in combating illegal trading practices. These regulations aim to foster transparency and maintain integrity in the markets, ensuring that investors can operate under fair conditions.

Challenges Posed by Pseudonymity and Fragmented Infrastructure

The advent of technology in cryptocurrency markets has introduced both opportunities and challenges, particularly in the area of wash trading detection. The inherent pseudonymity of blockchain networks often obscures the true ownership of accounts and addresses. This characteristic complicates efforts to surveil and investigate illegal trading activities effectively.

Additionally, the cryptocurrency landscape features a vast array of tokens and a fragmented infrastructure, which presents a stark contrast to traditional financial markets. The sheer number of platforms and assets complicates liquidity creation and makes the standardization and enforcement of compliance measures more difficult for institutions.

Compliance challenges are exacerbated by the limitations of advanced analytical tools and market alerts, which can generate false positives and misinterpret suspicious activities. In this environment, the absence of a unified view further hampers the ability to detect market manipulation effectively.

Consequently, firms are required to implement coordinated strategies for the detection and prevention of such activities. Moreover, current regulatory frameworks, such as those provided by the Exchange Commission, often struggle to keep pace with the rapid evolution of the crypto market, highlighting the need for more adaptive regulatory approaches.

Regulatory Initiatives Addressing Market Manipulation

In response to increasing regulatory scrutiny of cryptocurrency markets, various authorities globally are implementing specific measures aimed at mitigating instances of wash trading and other forms of market manipulation.

Regulatory bodies, including the U.S. Securities and Exchange Commission (SEC), have begun to establish strict requirements for trading accounts, monitoring token activity, and enhancing surveillance systems.

These regulatory frameworks necessitate that firms improve their mechanisms for detecting and investigating potentially illicit activities, which should include generating alerts for suspicious transactions and illegal trading practices. Countries such as Canada, members of the European Union, and the United Kingdom are actively enforcing compliance, a process that is often mirrored in Asian markets.

The overarching goal of these initiatives is to create a more unified regulatory perspective across a multitude of cryptocurrencies and high-volume trading operations.

While challenges related to market manipulation persist, the implementation of advanced technologies is facilitating the detection and prevention of coordinated trading activities, false positives, and offenses related to liquidity.

These advancements are essential for fostering a more transparent and equitable trading environment within the cryptocurrency landscape.

Advanced Analytical Techniques for Detection

Crypto exchanges face the ongoing challenge of distinguishing between legitimate trades and those indicative of coordinated market manipulation. To address this issue, advanced analytical techniques have become increasingly important. Strategies such as transaction timing analysis and monitoring token flows among multiple senders are essential in identifying suspicious activity.

In addition to these methods, network analysis and AI-driven surveillance systems are critical for generating high-confidence alerts, ultimately minimizing the incidence of false positives. By linking trading accounts and addresses within a unified framework, analysts can map the relationships between various tokens and transactions, providing deeper insights into trading patterns.

It is imperative for both institutional investors and cryptocurrency markets to adapt their compliance frameworks in response to the evolving regulatory landscape, recognizing that manipulation remains illegal under the jurisdiction of the Exchange Commission.

Consequently, firms must prioritize the automation of financial crime detection and investigation across all trading activities to ensure robustness and compliance in their operations.

Institutional Practices for Strengthening Surveillance

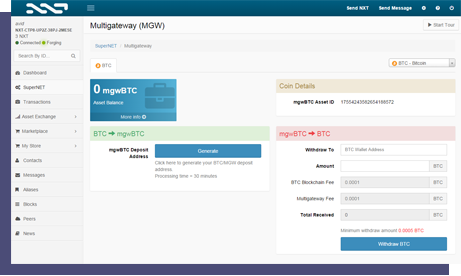

Effective surveillance of cryptocurrency markets is contingent upon the implementation of transparent monitoring systems that can assess trading activities across various platforms in real time. Institutions are advised to develop a cohesive overview of accounts, addresses, and tokens. This comprehensive perspective is essential for tracking trades accurately.

To enhance detection of potentially illicit activity, it is important to establish alerts for suspicious transactions, such as consistent buying and selling of the same asset, which may indicate attempts to manipulate market liquidity.

Utilizing high-quality analyses in conjunction with robust compliance processes is critical for identifying illegal wash trades.

Additionally, adherence to regulatory frameworks necessitates that firms continually adapt to emerging market manipulation tactics. Therefore, it is advisable for institutions to allocate resources towards developing skilled teams and employing advanced technology.

Compliance with established Terms of Use, Privacy Policies, and Rights Reserved is integral to the execution of effective market surveillance strategies.

The Evolving Role of AI and Technology in Prevention

Cryptocurrency markets are characterized by their distinct challenges related to surveillance and regulation. Recent advancements in artificial intelligence (AI) have notably enhanced efforts to detect and prevent wash trading, a manipulation tactic that can distort market activity. Current technology enables the integration of trading analysis, offering a comprehensive view of accounts, addresses, and transactions.

This AI-driven approach is effective in minimizing false positives while also streamlining compliance processes. Importantly, institutions operating in these markets require advanced capabilities to identify and flag coordinated transactions, suspicious behaviors, and the repeated trading of the same asset across numerous tokens.

This necessity arises from the heightened risk of financial crime associated with market manipulation in the cryptocurrency space. Consequently, regulatory bodies, including the Securities and Exchange Commission (SEC), are increasingly emphasizing the importance of developing systems that can adapt and respond to evolving tactics in detection and investigation.

The implementation of these technologies is critical for maintaining market integrity and ensuring that compliance measures align with the dynamic landscape of cryptocurrency trading.

Conclusion

Wash trading poses a persistent threat to crypto market integrity, undermining trust and distorting prices. You can't afford to ignore its impact or the evolving methods used to detect and prevent it. Strong surveillance, collaboration with regulators, and investment in advanced analytics are essential steps. By staying proactive and informed, you help foster a transparent, trustworthy environment for all market participants—making the space safer and more resilient against manipulation.